Basics of Grid Trading with ATHgrid

Our strategy is based on the concept of Grid Trading but with intelligent enhancements. Instead of predicting market direction, ATHgrid profits from volatility—automatically buying when prices drop and selling when they rise, within a predefined range. The bot also initially places buy orders above the current price, allowing it to trade even when the price is already rising from the start (all within the designated grid range).

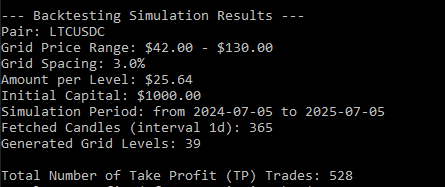

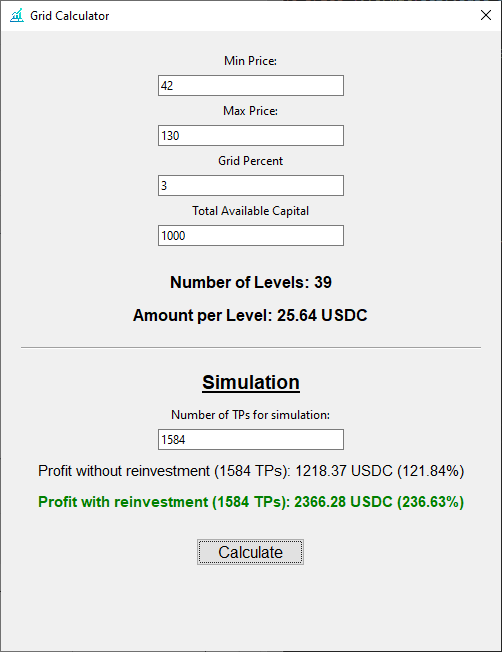

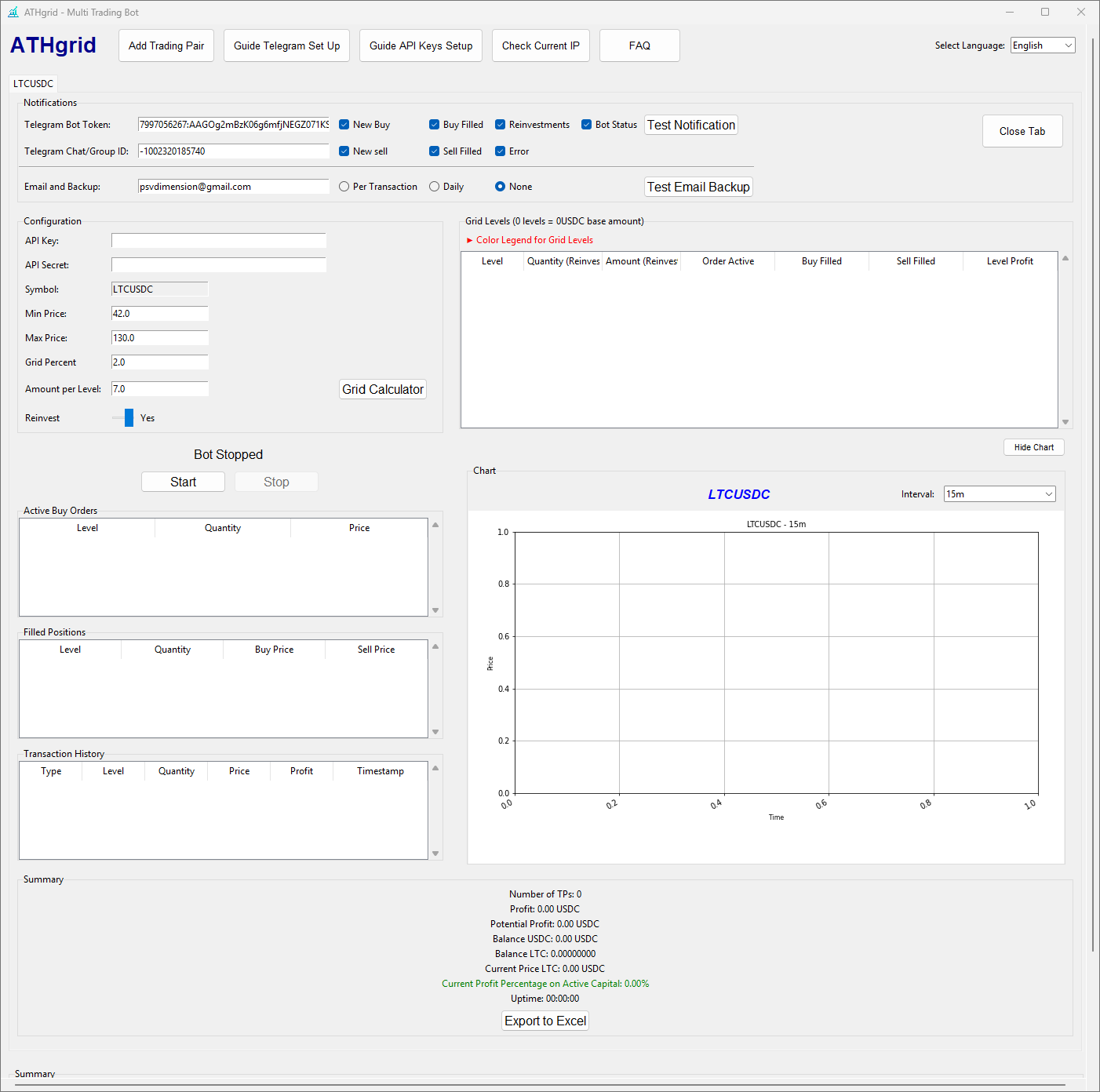

The bot creates a “grid” of buy and sell orders based on your parameters: Min Price, Max Price (operational range), and Grid Percent (grid density). Key to this is dynamic order management: ATHgrid maintains active orders only at the nearest levels around the current price, ensuring more efficient capital use and minimizing frozen funds.

Discipline and Capital Management

The most critical aspects of this strategy are discipline and proper capital base management. For the strategy to work effectively and safely, you must ensure sufficient funds on your exchange account to cover potential buy orders at all grid levels. This “capital base” allows the bot to operate uninterrupted, even during market downturns.

Our bot ensures you stay in the game by placing only a maximum of 6 active orders at any time. This intelligent management maximizes potential profits while keeping most of your capital available, not locked in distant orders.

The Power of Reinvestment (Compound Interest)

ATHgrid also offers an automatic profit reinvestment feature. When activated, every profit realized at a grid level is automatically added to the base amount for subsequent trades at that level. This is a powerful mechanism that allows you to leverage the effect of compound interest, increasing your long-term profits without any additional intervention.