Bitcoin Dominance (BTC.D) and Altseason: Do You Have a Plan?

Bitcoin Dominance and its most important question:

Bitcoin Dominance and its most important question:

“When altseason?” It’s the question on every crypto investor’s mind. While countless influencers offer predictions, experienced traders turn their attention to one single chart that tells the real story: Bitcoin Dominance (BTC.D). Understanding this metric is key to navigating the market and preparing a strategy, regardless of what comes next.

What is Bitcoin Dominance (BTC.D)?

Simply put, Bitcoin Dominance is the percentage of the total cryptocurrency market capitalization that is held in Bitcoin. You can track it live on platforms like TradingView. Why is this chart so important for altcoin investors?

Historically, it reveals the flow of capital within the crypto ecosystem. A true, explosive “altseason” typically follows a specific pattern:

- Money flows into Bitcoin first, causing its price to rise and BTC.D to increase.

- As Bitcoin’s momentum slows, profits are rotated into major altcoins (like ETH). This causes BTC.D to start falling.

- If the trend continues, capital then flows further down into mid and low-cap alts, causing widespread, parabolic gains across the board. This phase is marked by a sharp, sustained drop in Bitcoin Dominance.

Current Analysis: A Local Breakdown or Just a Pause?

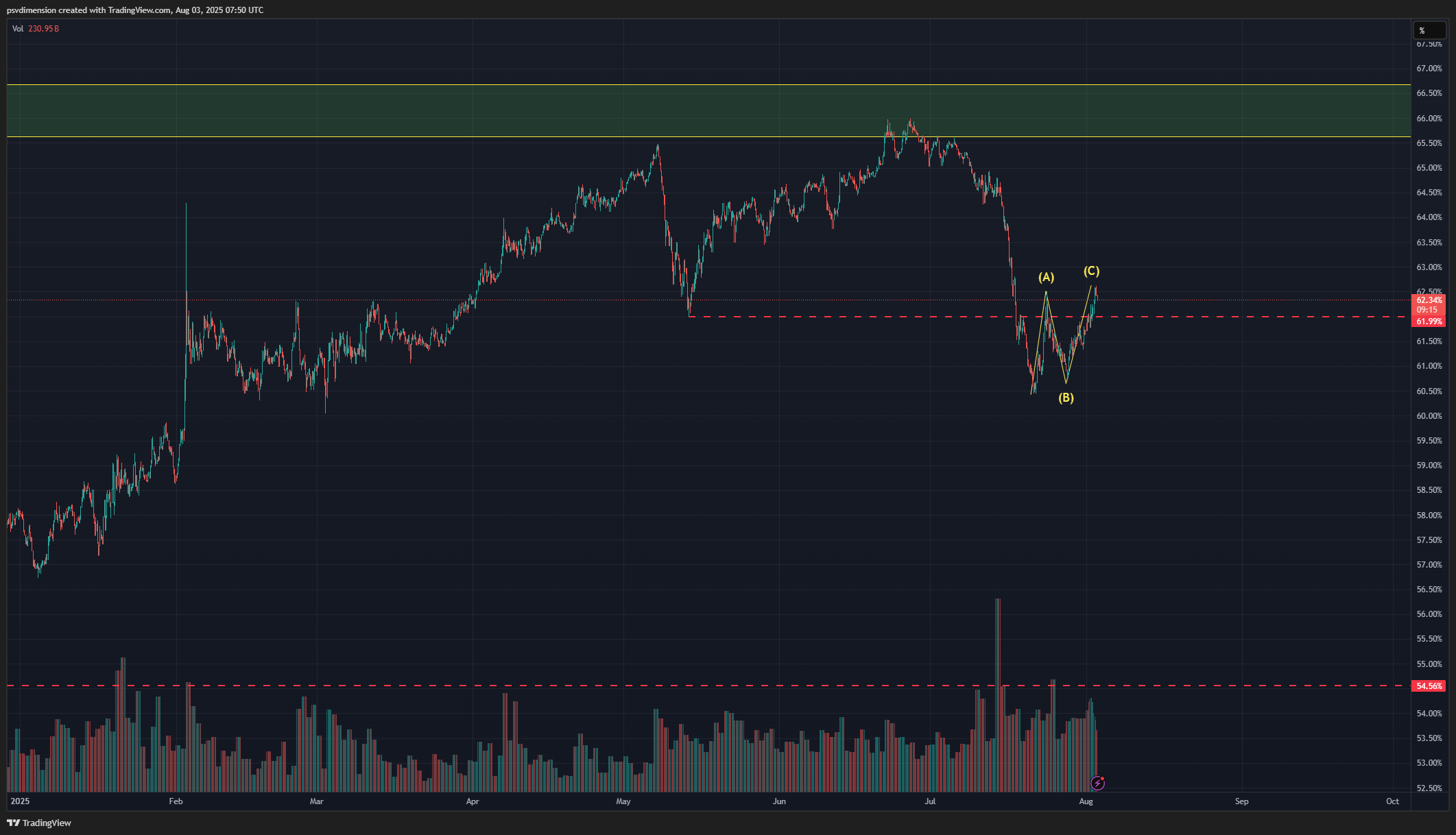

Looking at the recent price action, we can see that BTC.D experienced a local trend breakdown at the 61.90% level. As is common after such a break, we are now seeing a corrective bounce upward, beautifully forming a classic ABC corrective wave. The crucial question now is: is this just a temporary correction before dominance continues to fall (giving altcoins more room to breathe), or is it a consolidation before BTC regains strength and continues to climb?

It’s important to remember that a small dip in BTC.D doesn’t automatically mean a full-blown altseason. Often, it just provides a short “relief rally” for alts before Bitcoin continues its climb.

The Bigger Picture: The One Level That Truly Matters for Altseason

While the short-term movements are interesting for traders, the long-term picture provides much more clarity. Globally, one of the most important support levels for Bitcoin Dominance is at 54.50%. A decisive break below this level is what could truly signal that a major, sustained altseason is upon us. Until that happens, any drops in dominance can be considered larger relief rallies.

The Strategic Answer: Trading the Uncertainty

So, we are left with uncertainty. Will dominance fall, sending alts flying? Or will it rise again, putting pressure on altcoin valuations? If you don’t want to worry about this, if you’re tired of guessing and want psychological freedom, you need to think about a strategy that works regardless.

This is where a systematic approach like Grid Trading becomes invaluable. Instead of trying to predict the outcome of the BTC.D chart, you can set up a grid bot on a solid asset you believe in long-term. A bot like ATHgrid doesn’t care if it’s altseason or not. It trades the volatility, accumulating small, consistent profits from the price swings that happen every day, week, and month. It’s a plan that works while you wait for the market to reveal its hand.

While everyone else is stressed, watching the dominance chart and hoping for a specific outcome, your system is simply working, building your portfolio one trade at a time.

Ready to trade with a plan instead of a prediction? Download ATHgrid and discover the psychological freedom of automated, systematic trading.

Leave a Reply