The Ultimate Guide to Grid Trading: A Strategy for Any Market Condition

Grid Trading for beginners

Is Diversification Everything? What If the Market Has Other Plans?

Many investors in the cryptocurrency market believe in the mantra of diversification. We spread our capital across many promising projects, which is, of course, a correct risk management practice. But what if the altseason everyone is waiting for never comes? What if the market pulls back again and enters an accumulation phase for the next 2-3 years? Do you have a plan for that?

Or maybe altseason will arrive, but it will only be a momentary, euphoric spike, after which, as always, a long night and silence in the market will follow? What then? What’s your plan…?

There is one answer: Grid Trading. A strategy that allows you to earn where most people cry – during periods of volatility and sideways trends. With carefully selected assets and a system like ATHgrid, you can turn market uncertainty into your advantage.

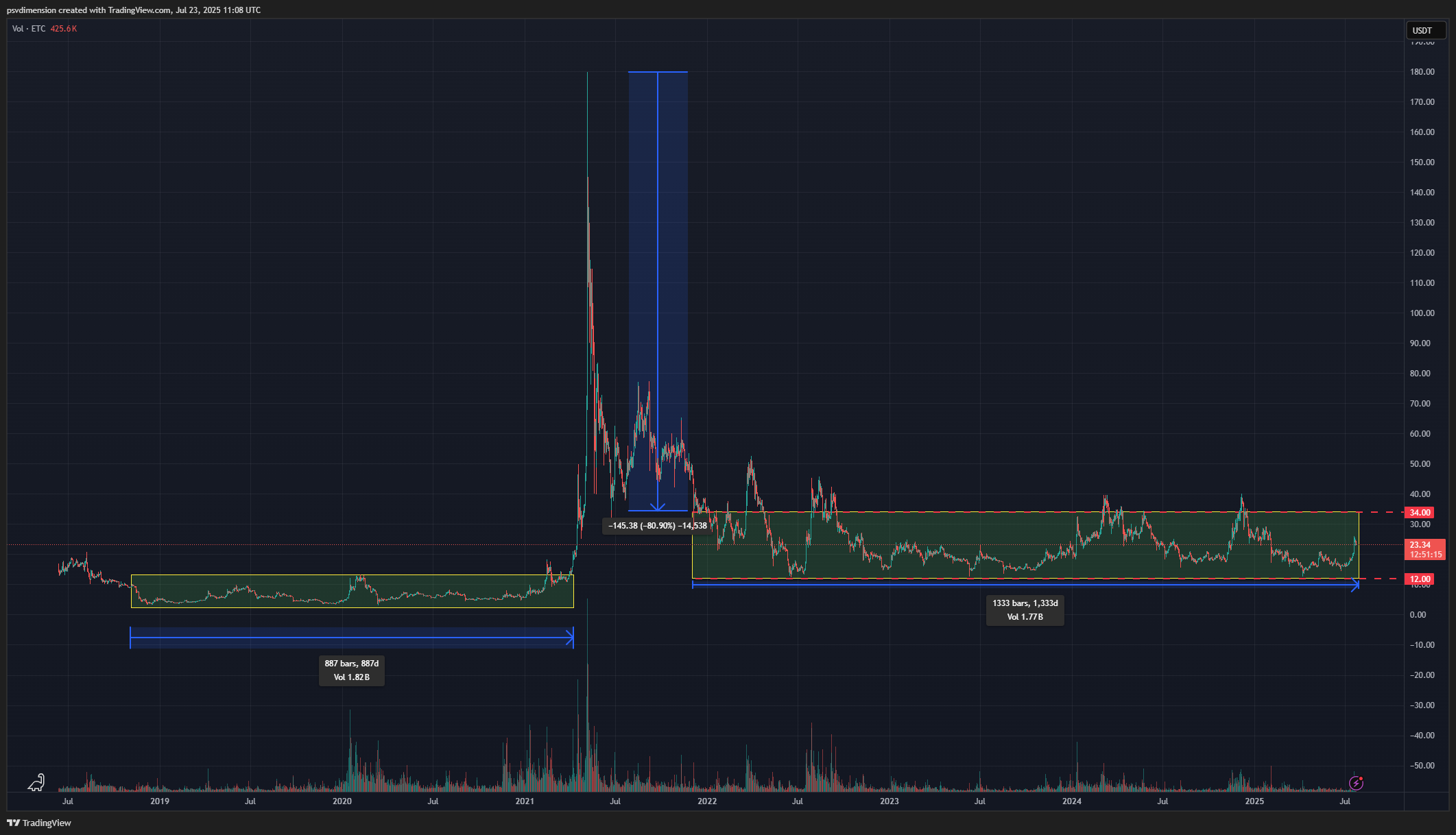

History Likes to Rhyme: A Lesson from the ETCUSDT Chart

Let’s look at our case study – the ETCUSDT pair. An analysis of the historical chart teaches us patience. After the 2018 bull market highs, Ethereum Classic entered a period of bear market and accumulation that lasted a full 887 days! After such a long period of “silence,” a powerful upward shot occurred.

And what’s next? The market began to consolidate again. It is in these long, seemingly “boring” periods that the real fun for the grid strategy begins.

Planning the Grid: A Strategy for Survival and Profit

The safest and most effective approach is to set up the grid for the long term. We start by identifying solid, established projects that have already survived at least one bear market. We wait until the price of a given asset drops by about -80% from its all-time high (ATH). It is in this zone of “fear” and “panic” that we begin to build our position.

For our ETCUSDT example, whose peak was ~$176, an 80% drop gives us a price around $35. Our plan involves setting up a grid in the range of $12 to $34. Why this range? The lower bound ($12) is near the bottom of the previous bear market, and the upper bound ($34) is a significant resistance level that has been tested multiple times. We will set up the grid with levels every 5%.

(If you need a helper script for TradingView that assists in visualizing and deploying grids, contact us).

How Does the Grid Trading Bot Work? Discipline and Automation

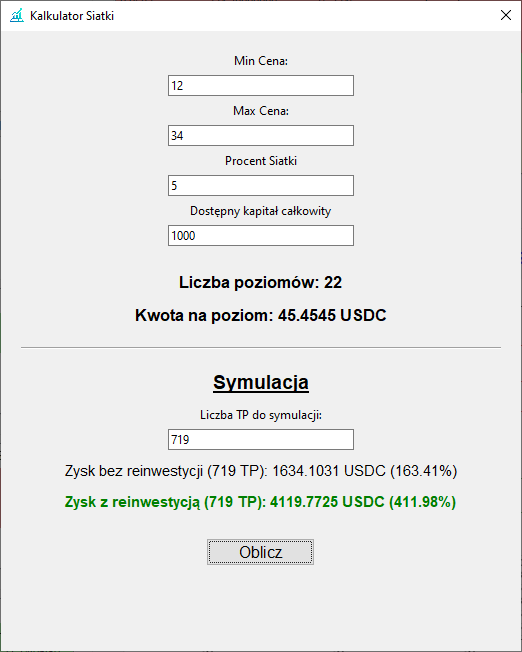

Let’s assume we allocate $1000 to this strategy. How does our bot manage this capital? Let’s use our “Grid Calculator” tool.

After entering the data (range $12-$34, levels every 5%, capital $1000), the calculator determines that we have 22 levels in the grid, and we should allocate $45.45 per level. This is the key to success – we must have enough capital to cover all buy orders within our range. Discipline is fundamental.

When we start the bot at a price of, for example, $18, it begins to operate, placing several buy orders below and several buy orders above the current price. But why does it buy up? This is a unique feature of the “long” strategy, which allows earning even if the price only rises from the moment the bot is started. When the price reaches a level of, say, $18.90, the bot buys this position and immediately sets a sell order 5% higher, at ~$19.85. When the price gets there, the position is sold at a profit, and the bot immediately places another buy order at the same level, while also activating a new buy order at the next, higher grid level.

And what happens when the trend reverses? The bot, which always maintains 5-6 active orders around the price, begins to buy back cheaper the same levels it previously sold higher. During high volatility, the bot can execute several such trades in a single day on the very same price levels!

What If the Price Leaves the Grid? Patience Over Panic.

Our strategy does not use stop-losses. If the price falls below $12 or rises above $34, the bot simply stops trading and patiently waits for the price to return to the grid. This protects us from sudden moves, so-called “springs,” which often “wash out” traders from the market who use tight stop-losses. The bot simply gets back to work when the conditions are favorable again.

Of course, if the price falls after starting the bot, the initially opened positions will be at a loss. This is natural. It is precisely here that patience and discipline are key, which over time will bring the desired profits when the trend reverses.

The Results Speak for Themselves: Backtesting and Simulation

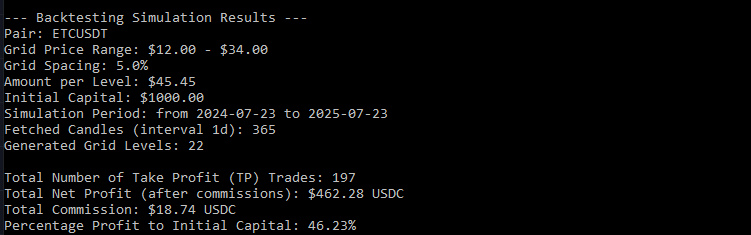

We conducted a backtest for the ETCUSDT pair on Binance for the last year (the maximum period available on the exchange). During this time, the bot executed 197 Take Profit trades.

Extrapolating these results over the entire bear market period for ETC (1333 days since the end of 2021), our simulation shows that the bot could have executed as many as 719 Take Profit trades. And here is where the magic begins:

- Without reinvesting profits: We achieve a ~163% return on capital. This is a safer option, where profits are regularly set aside.

- With reinvesting profits: The magic of compounding comes into play. The profits from each trade are added to the capital for that level, increasing future profits. In this scenario, the simulated return is a staggering ~412%!

There is one condition: to realize the full potential, we must patiently wait for the price to reach the upper boundary of the grid. The advantage of our bot is that by maintaining only 5-6 orders at a time, it does not lock up all the capital, allowing more advanced traders to flexibly manage their funds and maximize profits.

Grid Trading is not a get-rich-quick scheme. It’s a marathon, not a sprint. It is a method for the patient and disciplined, allowing you to build capital systematically and thoughtfully, regardless of whether euphoria or fear prevails in the market.

Ready to put these strategies into action without being glued to a screen? Download ATHgrid today and start automating your trading on Binance!

Leave a Reply