Level Trading vs DCA

Level Trading vs. DCA – A Strategy for Long-Term Players

In the world of cryptocurrency investing, there are many approaches to capital management. One of the most popular methods is Dollar-Cost Averaging (DCA), which involves systematically buying a given cryptocurrency at regular intervals, regardless of the price. While DCA has its advantages – simplicity and minimal time commitment – it also has drawbacks: capital is often frozen for a long time, and the investor must wait for the price to exceed their average entry. An alternative is Level Trading, which allows you to treat each position separately, realize profits faster, and repeatedly play the same price zones, combining elements of trading and long-term investing.

What is Level Trading?

The Level Trading strategy involves identifying key support and resistance zones on a chart (most often on D1, W1, or M1 intervals) and building a position only when the price reaches these areas. Each transaction is independent – there is no averaging as in DCA.

Key principles of the strategy:

- Identify 3-4 major price zones based on a weekly or monthly chart.

- Set buy limit orders at these levels.

- Treat each position separately – you sell 100% of the position at a predetermined target (Take Profit).

- Replay the same zones – if the market returns to the same level, you can re-enter and play it again.

- Free up capital – thanks to this, you realize profits cyclically instead of waiting months for your average purchase price to break even.

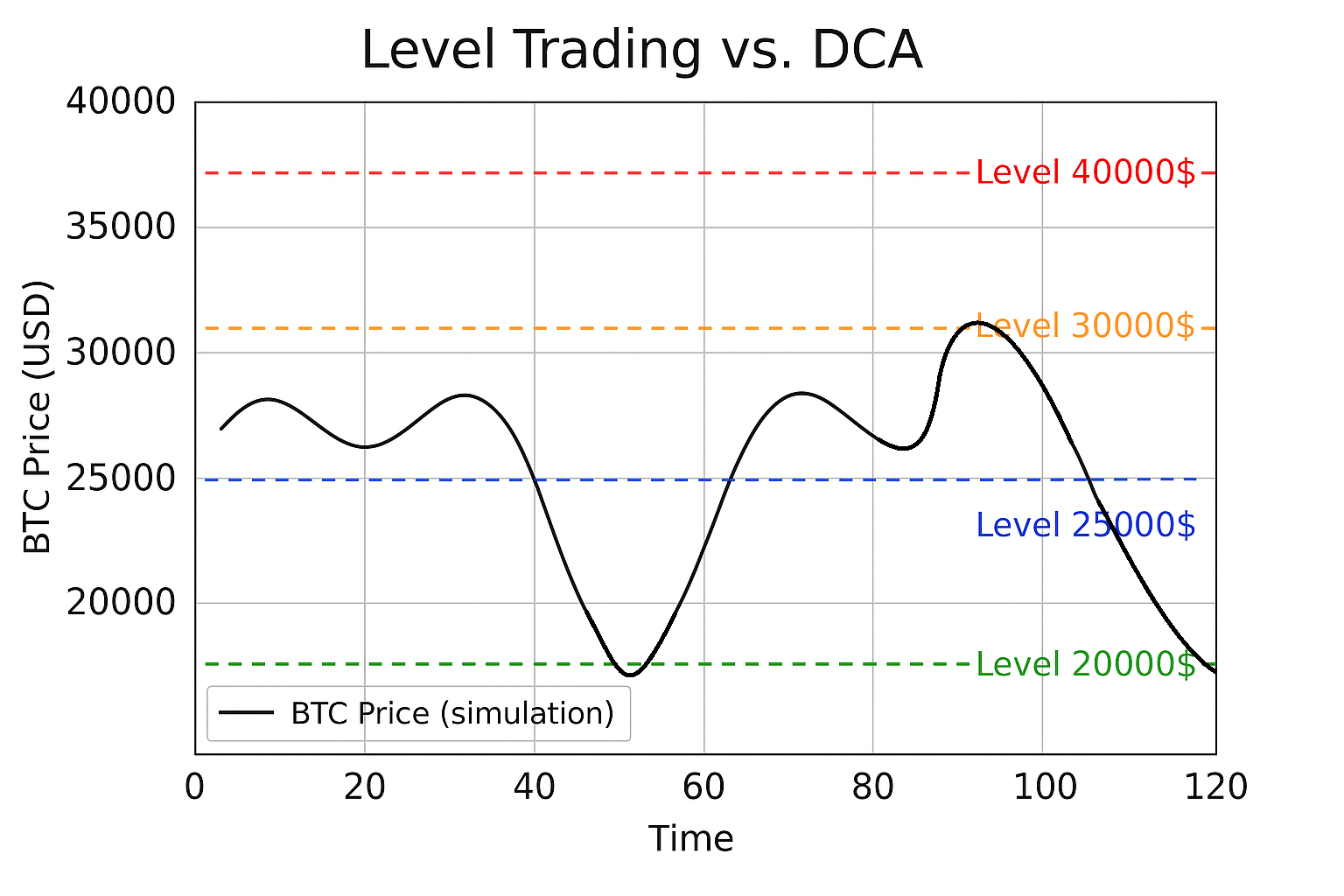

Example: A Hypothetical BTC Scenario

Let’s assume BTC is moving in a large price range between $20,000 and $40,000, and we want to play several levels. Our plan could look like this:

- Level 1: Buy at $20,000 → Sell at $25,000 (+25% profit)

- Level 2: Buy at $25,000 → Sell at $30,000 (+20% profit)

- Level 3: Buy at $30,000 → Sell at $40,000 (+33% profit)

When BTC drops to 20k, your order is filled, and you set a sell order at 25k. If the market drops to 20k again – you have a second opportunity for the same profitable trade. Your capital is constantly working, and you are cyclically taking profits.

Hypothetical buy/sell levels for BTC.

Comparison: DCA vs. Level Trading

| Feature | DCA | Level Trading |

|---|---|---|

| Simplicity | ✅ Very simple | ❌ Requires level analysis |

| Time Commitment | ✅ Minimal | ✅ Low (high timeframes) |

| Risk of Frozen Capital | ❌ High | ✅ Low (cyclical profit-taking) |

| Profit Potential | ❌ Limited | ✅ Higher with a good plan |

| Flexibility | ❌ None | ✅ Full control over positions |

Why This Strategy Excels in Crypto?

The cryptocurrency market is characterized by immense volatility. Moves of 20-30% in a short time are normal. Level Trading allows you to use this volatility instead of fighting it. Instead of watching your DCA portfolio drop by -50%, you are realizing further profits at lower levels, accumulating capital for the next move up.

Summary

Level Trading is a strategy that combines the simplicity of long-term investing with the efficiency of trading. Thanks to it, you are not dependent on an average purchase price like in DCA; you manage each position individually and use the natural cycles of the crypto market to generate repeatable profits.

Want to automate your Level Trading strategy? Discover ATHgrid and let a bot execute your plan with precision 24/7.

Leave a Reply