Crypto Capital Management: Build Your Fortress for Long-Term Profit

Capital Management: Why Your Plan is More Important Than Your Trades

In the chaotic world of crypto trading, most people are searching for the perfect entry, the secret indicator, or the one trade that will change their lives. But they are looking in the wrong place. Your long-term success is determined not by your trading prowess, but by something far more crucial: your capital management. Without a solid plan and strategy, you can’t build a financial fortress. You’re just a gambler waiting to lose.

The Cracks in the Walls: 10 Mistakes That Demolish a Trader’s Fortress (Capital Management)

Before you can build, you must understand what causes collapse. Most trading accounts are destroyed by a series of predictable, self-inflicted mistakes rooted in flawed psychology and strategy.

Are you trading based on emotion or a concrete plan?

1. “Gut Feeling” Trading (Based on Emotion)

This is a trader’s cardinal sin. Decisions made based on a “hunch,” excitement, or fear, instead of a tested strategy, are a direct path to blowing up your account. The market doesn’t reward hope, it rewards a well-executed plan.

2. Chasing Profits (FOMO)

You see a green candle shooting for the sky and feel the compulsion to buy, otherwise you’ll miss a life-changing opportunity. That’s FOMO (Fear Of Missing Out). The brutal truth is: if you weren’t buying at the bottom, buying at the peak of euphoria is statistically the worst possible time to enter the market.

3. Lack of Patience

Impatience destroys even the best plans. It leads to closing profitable positions too early (out of fear of giving back profits) or holding losing trades for too long (in the hope that “it will bounce back”). Discipline and sticking to the plan are key.

4. Ignoring Risk

Every professional is a risk manager first, and a trader second. Entering a position without a defined stop-loss and without knowing the maximum you could lose is pure gambling. Always ask yourself: “How much will I lose if I’m wrong?”.

5. Overtrading

The feeling that you must be “in the market” at all times leads to forcing trades even when there are no good opportunities. Sometimes the best trade is no trade at all. Capital is like ammunition—don’t waste it on random shots.

6. Poor Math & Not Understanding Compound Interest

Many traders don’t understand the most powerful force in finance: compound interest. It’s the consistent reinvestment of even small profits that leads to exponential growth over the long term. The reinvestment feature in the ATHgrid bot is based on this very principle, turning small wins into a powerful snowball.

7. Wishful Thinking

Believing the market “has to” turn around because “it has dropped enough” or that “it will only go up” is a direct path to disaster. The market is indifferent to your hopes and expectations. Follow the data, not your wishes.

8. Ignoring Taxes and Inflation

A 50% gain in your account is not a 50% real profit. You have to subtract the taxes you will pay and the inflation that has diminished the purchasing power of your money during that time. Always think in terms of net profit.

9. Trading with Money You Need

This is a cardinal mistake. Using money from your emergency fund, living expenses, or, worst of all, loans, is the fastest way to ruin. Only trade with surplus funds that you can fully afford to lose, both financially and mentally.

10. Blindly Following “Gurus”

You can learn from experts and follow the analyses of others (including mine), but treating them as oracles is a mistake. Everyone is wrong sometimes. The final decision and responsibility always rest with you. Use the knowledge of others to build YOUR OWN management plan.

Building Your Fortress: A Practical Allocation Plan

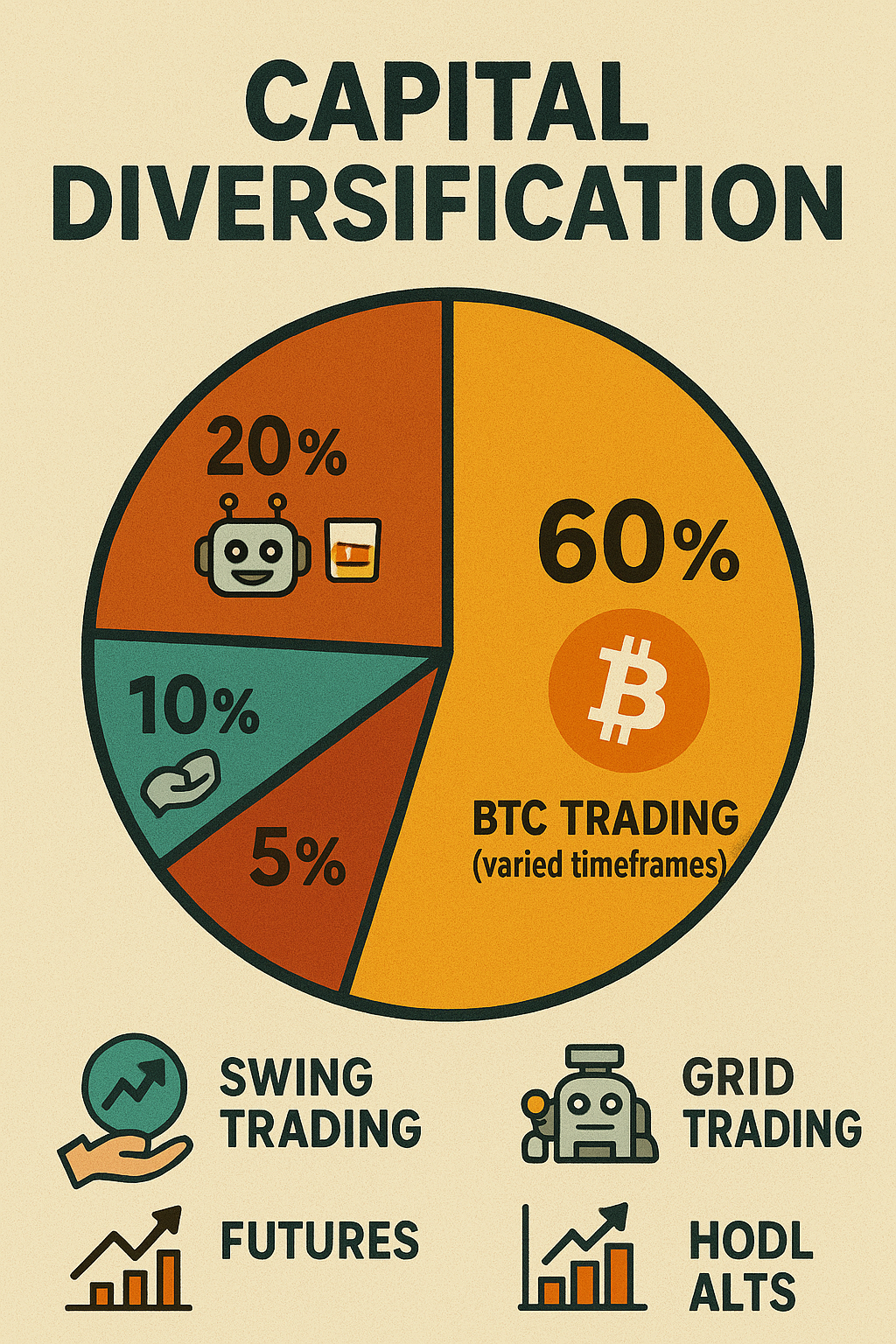

So, how do you build your fortress? You create a clear, written plan for how your capital will be allocated. This removes emotion and guesswork. Here is a sample strategy you can adapt:

- 60% – Bitcoin Trading: This is the core of your fortress. Your capital is allocated to trading the most established asset in different timeframes (long, medium, and short-term).

- 20% – Grid Trading: This is your automation wing. Set up bots on volatile pairs and let them work 24/7. This is the part of your plan that earns while you sleep, profiting from market noise. Time for a glass of whisky while the system works.

- 10% – HODL Altcoins: A portion of your capital dedicated to holding high-potential altcoins that you believe in long-term.

- 5% – Swing Trading: Actively trading specific altcoin setups over days or weeks.

- 5% – Futures: A small, high-risk portion for leveraged trading, if you have the expertise.

The key is to define your percentages and stick to the plan. Haste and greed will destroy you; patience and discipline will build your fortress, brick by brick.

Conclusion and What’s Next

Stop focusing only on finding the next winning trade and start focusing on building a resilient capital management system. Your plan is your shield and your sword in the market battlefield.

In the next article, I will dive deeper into a specific strategy: how to buy at key levels and why it’s often a better approach than classic DCA (Dollar-Cost Averaging). Stay tuned.

Ready to automate a part of your financial fortress? Discover ATHgrid and let a systematic Grid Trading bot handle the market volatility for you.

Leave a Reply