FOMO vs. A Cool Head: Why a Rising Market Should Scare You, Not Excite You

FOMO vs. A Cool Head: Why a Rising Market Should Scare You, Not Excite You

Ask yourself a simple question: when do you feel the strongest urge to buy cryptocurrencies (or any other asset)? It’s probably when everyone on X (Twitter) is posting about insane profits, and the green candles on the chart seem endless. This feeling, this mix of excitement and fear that you’re missing out on a life-changing opportunity, has a name: FOMO (Fear Of Missing Out). And it is the main reason why most people lose money.

Your Brain Was Not Designed for Trading

Our brain evolved over thousands of years to help us survive in a herd. Following the crowd was safe. Being excluded meant danger. FOMO is nothing more than this primal instinct transferred to the financial markets. The problem is, in the stock market, the logic of the crowd works in reverse. When everyone is buying in euphoria, it usually means that “smart money” is already selling their assets to them at inflated prices.

Let’s imagine a simple example. At first, a handful of visionaries buy a unique item, seeing its potential while others ignore it. Over time, a trend builds around the item. Suddenly, at the peak of its popularity, owning it becomes a necessity. The crowd rushes to buy, driving the price to absurd levels.

What do the original owners do? Seeing this insane demand, they calmly sell their items to the crowd, realizing huge profits. Eventually, a saturation point is reached – everyone who wanted to buy has already done so. The problem is, the last buyers are left with an asset that no one wants anymore, and they have no one to sell it to at a higher price. The value begins to plummet.

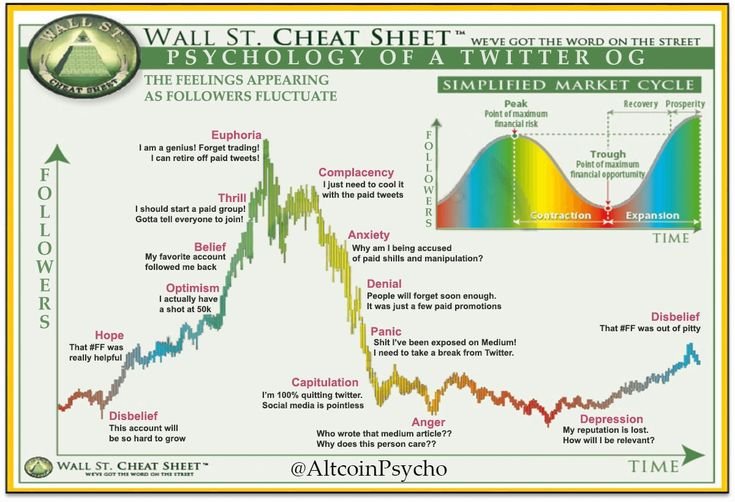

The Cycle of Emotions – A Map of Your Future Failure

The chart below is the “Wall Street Cheat Sheet” the most famous map of market emotions. Find the “Euphoria” point on it. This is the moment when you feel like a financial genius and are certain of further gains. It is also the peak of the bubble, right before the biggest crash. It works every time.

Euphoria is the point of maximum financial risk.

Professional investors act contrary to this cycle. They buy when “Depression” and “Disbelief” prevail on the chart. They sell during “Thrill” and “Euphoria.” They understand that a rising chart and widespread optimism are signals to start being afraid and take profits, not to join the party.

How to Win Against Yourself? Stop Fighting.

You can read hundreds of books on trading psychology, but the moment large sums of money (or large losses) appear in your account, your primal instincts will take over anyway. The fight against your own psyche is doomed to fail. The only effective solution is to completely remove emotions from the decision-making process.

How to do it? Automate your strategy.

ATHgrid: Your Cool Head in Code Form

This is the philosophy behind systems like Grid Trading. Instead of making frantic decisions based on fear or greed, you establish a logical action plan and let a program execute it for you.

A tool like ATHgrid is your personal, emotionless trader. It:

- Doesn’t feel FOMO when the market is rising.

- Doesn’t panic when the price drops.

- Systematically buys low and sells high as part of your strategy, 24/7.

Instead of being a slave to the cycle of emotions, you become its observer, while your system methodically works for your profit. This is true psychological freedom in trading.

Ready to hand over the trading to a machine and keep the peace of mind for yourself? Discover ATHgrid and see how systematic trading beats emotions.

Leave a Reply